Articles and Market Commentary

Back to the Basics - Investing Amid Market Turbulence

The Federal Reserve Bank (the “Fed”) governors just concluded their annual trip to Jackson Hole. The trip was punctuated by a rather “hawkish” press conference by Chairman Jerome Powell where he emphasized a concern over inflation and the group’s commitment to focusing on it until “the job is done.”

The Federal Reserve Bank (the “Fed”) governors just concluded their annual trip to Jackson Hole. The trip was punctuated by a rather “hawkish” press conference by Chairman Jerome Powell where he emphasized a concern over inflation and the group’s commitment to focusing on it until “the job is done.” The equity markets wobbled in response as investors internalized that another 75 basis-point rate hike was likely in store for September with potentially more to follow. Fed actions have contributed to significant market volatility of late and it appears we have more to come. We can’t control Fed action and short-term market pullbacks, but market volatility provides an opportunity to get back to the basics and revisit some “tried-and-true” ways to add value to portfolios.

One potential area to add value is to take advantage of free money as we will discuss below. Traditional IRAs, Roth IRAs, 529 Education Savings Plans and employer retirement plans are all areas of opportunity. For one, many investors have the potential to reduce taxes (i.e., lower taxable income) or get free money (i.e., employer contribution matches) by contributing to retirement plans. If this is an option for you, it should be taken advantage of as it represents one of the best sources of return in investing. Moreover, most of these plans can appreciate without incurring taxes each year (i.e., taxes are deferred until contributions are withdrawn). By deferring taxes, one is typically able to then reduce taxes because a deferral provides more flexibility for tax-mitigation strategies over time. Also, often one will be taxed in retirement at a lower tax rate than they are taxed in their prime earning years. It’s never too late to add to retirement accounts and the government has many “catch up” provisions for late starters. For example, those over 50 can contribute larger amounts to IRAs (i.e., $7,000/year) and 401ks (i.e., $27,000). Business retirement plans typically provide tremendous opportunity given the annual contribution limits are substantially higher than individual plans. Patina Wealth can assist in setting up business retirement plans if this is of interest.

Another key area of focus for turbulent times is to continue adding to investments. The equity market has proven to be a great investment in the long-term but can be subject to significant short-term drawdowns. Market drawdowns can present a buying opportunity. For those with annual salaries, it is important to continue to add to investments through drawdowns as it lowers the average “cost basis” of investments and leads to better long-term performance. This tactic can be deployed by increasing one’s discretionary savings rate (i.e., increase the portion of salary that is set aside for long-term investing) or simply by continuing to invest through retirement plans which more typically pull money and invest it on a set schedule. Similar, if it is financially feasible, one could consider “reinvesting dividends” across all investments rather than receiving them which will have the effect of buying more shares.

Of course, one of the best defenses against market uncertainty is to have a broadly diversified portfolio with varying risk exposures and tailor portfolio holdings based on individual needs. At Patina Wealth, we build custom portfolios and diversification is more than simply investing in stocks and bonds as we take an active approach. On the equity front, our models will, at times, call for an overweight to certain sectors as well as certain “factors” (e.g., value, growth or quality). By overweighting sectors and factors, risk-adjusted performance can be enhanced. Moreover, on the fixed-income side, we are active in managing bond risk (e.g., investment grade versus high yield) and “duration” (i.e., effective time to maturity for portfolios). By strategically adjusting risk and duration one can often mitigate drawdowns and provide opportunities for capital gains. Volatile markets can be stressful, but they also present an opportunity. So, keep looking for ways that you can strengthen your financial situation amid the turbulence.

Inflation is Enemy #1

As we’ve covered in recent blog posts, the past decade was one of unprecedented stimulus. The Federal Reserve Bank of the United States (the “Fed”), and other central banks, were arguably over-accommodative, through interest rate policy and an unprecedented increase in M2 money supply.

As we’ve covered in recent blog posts, the past decade was one of unprecedented stimulus. The Federal Reserve Bank of the United States (the “Fed”), and other central banks, were arguably over-accommodative, through interest rate policy and an unprecedented increase in M2 money supply. This massive stimulus contributed to the current inflationary environment, and now the Fed is doing its best to rein-in inflation via interest rate increases and “quantitative tapering” (i.e., a discontinuation of its bond buying program). The ongoing direction of inflation will continue to impact Fed actions, which, in turn, will impact markets. So, let’s explore where we’ve been and where we may be heading.

On the inflation front, the Fed is either not being forthcoming or, more likely, poorly modeling the impact of their actions. We were first told that inflation was not a concern, then told that inflation was transitory, and finally this gem - “We now understand how little we understand about inflation” (Jerome Powell, Federal Reserve Chairman, June 29, 2022). The continual pivots in rhetoric from the Fed do not inspire confidence. The Fed has two “mandates” which are (1) full employment and (2) stable prices. Oddly, the Fed has defined “stable prices” as steadily increasing prices at a rate of 2% per year. In this regard, they are way off target. Below is a chart of year over year inflation as measured by the Consumer Price Index (“CPI”) which represents a basket of consumer goods. Recent year over year changes have surpassed 9% which are levels not seen in the United States since the 1970s.

Inflation is widely considered to be detrimental for both individuals and economies. Individuals see their hard-earned dollars lose purchasing power and are thus forced to make consumption changes. Generally, discretionary spending (i.e., spending on non-critical goods) tapers during these periods with significant adverse economic impacts. In fact, historical analysis shows that rising energy and commodity prices can lead to recessions. Moreover, lower income individuals, along with retirees who are living on a fixed income, bear the brunt of price spikes as their incomes generally do not keep pace with inflation. As such, periods of rising inflation are often accompanied by significant civil unrest – a scary proposition for world leaders.

Given the inflation issues, the Fed, and other central banks are taking aggressive steps to stop it. For one, the Fed has been busy raising interest rates throughout 2022. After spending much of the last decade with a near-zero interest rate policy, they have increased the Federal Funds Rate 2.25%, in aggregate, since the beginning of the year (25bp in March, 50bp in May, 75bp in June and 75bp in July). Moreover, comments following the most recent increase on July 27th suggest that they will continue until inflation begins to move materially back toward target. At the same time, the 10-year treasury has fallen from 3.4% to under 2.8%. This suggests the market believes the Fed may slow down its pace of rate hikes, or perhaps, cut them as early as next year. Unless there is a swift, meaningful reduction in inflation, this doesn’t make much economic sense.

Many economists suggest that a recession is the only possible outcome from such aggressive rate hikes. In fact, history shows that recessions often follow central bank tightening. Recessions, however, have historically led to rising unemployment. So, the Fed’s dual mandates of “full employment” and stable prices may be in competition with each other. Based on Fed rhetoric, inflation is the primary concern at present, and it appears that the Fed is quite willing to cause “demand destruction” (i.e., reduced consumer spending and adverse economic impacts) to lower inflation. Based on the Fed’s public statements, it appears that rising unemployment is deemed the lesser of two evils.

So, the million-dollar question for portfolios is – “Where do we go from here?” Continued rate increases would prove detrimental for stock and bond prices in the short-term. However, any reversal of course (i.e., a pause in rate increases or rhetoric that suggests future changes will be below what the market now expects) would provide a tailwind as we saw in the few days following the Fed’s July announcement. It’s a tricky time for investors.

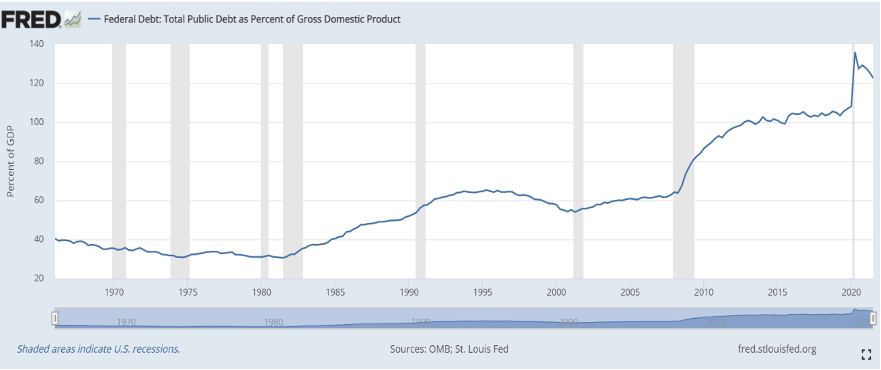

Our belief is that the Fed probably doesn’t have the ability to raise rates much higher than they are now. Businesses, along with the Federal Government itself, are highly indebted. So, by raising rates, the Fed is going to do damage to corporate profit margins and cause unemployment while potentially increasing the borrowing cost for itself. Below is the level of U.S. debt as a percentage of GDP. It’s been a long time since the U.S. government’s balance sheet looked this bad.

We have previously commented that the best way out of this predicament of a high debt-to-GDP ratio is probably the post-World War II playbook (i.e., let inflation run a little high until debt is reduced as a percentage of GDP) – See “Are We Headed for Yield Curve Control?”. In fact, governments haven’t historically paid off debt – rather, they generally either default or devalue currency until debt moves back to tolerable levels. So, despite the tough rhetoric about inflation, we would guess that the Fed would be comfortable seeing inflation higher than 2% for a while (e.g., 3-5% is our guess for the real near-term target level) and we may hit that pace before the end of 2022. As always, we will keep a close watch on the unfolding situation and will look for opportunities to capitalize.

2022 2nd Quarter Market Commentary

It would be an understatement to say that it’s been a tough first half of the year. As measured by the S&P 500 Index, the U.S. stock market (down 20.6% year-to-date) is off to its worst start since 1970. Similarly, the bond market, as measured by the Bloomberg U.S. Aggregate Index (down 10.4% year to-date) is on track for its worst year since 1973.

Top Headline for Q2: Worst “First Half” in 50 Years

It would be an understatement to say that it’s been a tough first half of the year. As measured by the S&P 500 Index, the U.S. stock market (down 20.6% year-to-date) is off to its worst start since 1970. Similarly, the bond market, as measured by the Bloomberg U.S. Aggregate Index (down 10.4% year to-date) is on track for its worst year since 1973. Normally, these investments are complimentary in investor portfolios (i.e., with one going up while the other is going down); however, the combined performance of these indices is among the worst in recent history. The industry standard “60/40 portfolio benchmark” comprised of 60% equities and 40% bonds is down 16.1% year-to-date. The next worst year in the last 50 was 2008 (which was down “only” 6.7%). In other words, the first 6 months of this year is thus far nearly 2.5 times worse than the next worst “first half” in the last 50 years.

As mentioned above, it’s been a rough year for both equities and fixed income. In the current market environment, it pays to be nimble. Shifts in bond duration and equity sector exposures will likely prove to have massive impacts on portfolios. While most Patina Wealth clients are down year-to-date, we are pleased with how client portfolios have performed relative to broad market indices. On the equity side of the portfolio, clients have benefited from an overweight of Value over Growth. Large Cap Value was -12.0% in the second quarter while Large Cap Growth was -22.4%. In addition, Patina Wealth’s “sector overlay”, where we allocate to specific sectors of the market we think will outperform the broader market provided a buffer to overall market declines. This strategy included having a Value overweight in sectors such as Financials, Energy, and Oil & Gas Exploration. On the fixed income side, portfolios were aided by having more exposure to short duration holdings which were less volatile during this rising rate environment. We are excited about continued opportunities to add value as we move forward in this volatile market.

General Market Update

US Equities: The pull back in equities accelerated in Q2. The S&P 500 Index fell 16.4% during the quarter, the Nasdaq Composite was down 22.4% and the Russell 2000 Index dropped 17.5%. These pullbacks were not unexpected given the equity market surge heading into the end of 2021 along with a highly anticipated “hawkish” Federal Reserve Bank (“Fed”) policy. Patina Wealth portfolios benefited from higher-than-average cash positions during the period coupled with more active rebalancing to take advantage of the increase in volatility. There were no “safe-haven” sectors found in Q2. However, the combination of client portfolios being overweight Value, in addition to our sector overlay, helped to avoid some of the equity market carnage seen in sectors such as Technology, Consumer Discretionary and Communications sectors, which are all down over 20% year-to-date.

International and Emerging Market Equities: The Schwab International Equity ETF (SCHF), which holds stocks of developed markets excluding the United States, was down 13.6% in Q2 and the Schwab Emerging Markets ETF (SCHE) fell 8.3%. Having lagged the U.S. markets in recent history, international markets are now slightly outperforming US markets for the same reason (i.e., a lower allocation to high growth technology stocks which are now giving up some of the recent gains). Diversified exposure to these markets proved beneficial to client portfolios throughout the quarter.

Fixed Income and Credit: The bond market slide accelerated throughout Q2 with longer-dated bond indices down well over 20%. The Federal Reserve Bank policies of raising rates and beginning quantitative tapering, as we anticipated, proved to be massive headwinds for the bond market. Moreover, the increases in interest rates are now affecting the risk perception in the corporate bond market as we have begun to see “bond spreads” (i.e., the interest rate premium investors demand from corporate bonds relative to treasury bonds) expand sharply. Although all global bond categories slid during the period, Patina clients benefited from a substantial overweight to shorter-duration higher quality bonds during the period.

Commodities, Precious Metals, Inflation: Inflation continues to be more persistent than most forecasters, including the Fed, predicted. The world has been working through inflationary impacts from unprecedented stimulus and now is faced with a general trend toward de-globalization and an ongoing war between Russia and Ukraine. Many commodities (including industry metals and lumber) have fallen from sky-high prices; however, supply constraints continue to cause major price spikes in the energy sector, especially in Europe, and experts see challenges for the food sector going forward (e.g., it has been reported that Russia and Ukraine produce over 25% of the world’s wheat). Precious metals have held up relatively well despite the “hawkish” narrative from the Fed which would normally send the market tumbling.

A Look Ahead

As we look to the future, all eyes will be on central bankers, and, most notably, the Federal Reserve Bank of the U.S. The Fed has been extremely hawkish in action and commentary in the face of rising inflation. For example, the June rate hike was hinted by the Fed to be 50 basis points but was shifted to 75 basis points. With limited impacts showing up in reduced inflation thus far, the market is now predicting another 75-basis-point hike in July and possibly another in September. At this point, it seems clear to all that inflation is now the number one enemy of the state and the Fed. Thus, many concede that a recession may result from Fed actions. Experts seem to think that driving the economy into a recession is a necessary step to reign in inflation though the Fed is not likely to make such a statement.

At this point, the equity market has retreated to reasonable valuation levels as measured by “forward-looking” earnings projections. In other words, the price-to-earnings ratio for the S&P 500 Index, based on the next 12 months of projected earnings, is back down to mid teen levels. However, the concern going forward is the accuracy of the earnings projections. If a recession is imminent, there is typically a sizeable pull-back in corporate earnings so equity investors will be watching each announcement for signs of degradation. Moreover, inflationary pressures are not good for corporations as rising input costs and rising wages generally hurt margins. We would anticipate that the equity market will face continued pressure with the worst performance being felt by companies with limited cash flow and lower quality balance sheets (i.e., those least prepared to survive an economic downturn). Other companies, however, will emerge stronger as many cash-rich companies, including some large cap growth companies, are well-positioned for acquisition.

We’re likely entering an extremely volatile period for the bond market. Any acceleration in Fed policy tightening could send the market tumbling (especially higher risk categories such as “high yield” that perform poorly during recessions). However, any Fed actions or guidance that suggest a pause or reversal relative to current expectations may lead to a surge in bond prices and a rapid drop in yields. Staying nimble in the current environment will be important as the market will be hyper-sensitive to the Fed.

Please feel free to reach out during this heightened period of volatility. We are more than happy to walk through portfolio allocations and the rationale behind various positions. We’re excited to closely monitor market movements and capitalize on opportunities ahead.

Bond Market Carnage

2022 is off to a very rough start for the bond market. Through May 5th, the Bloomberg Global-Aggregate Total Return Index, which represents a diversified pool of global bonds, is down over 12% - a loss of over $6 trillion in value. Certain sectors of the bond market have fared much worse (e.g., the long-term US Treasury bond ETF (“TLT”) is down over 23%).

2022 is off to a very rough start for the bond market. Through May 5th, the Bloomberg Global-Aggregate Total Return Index, which represents a diversified pool of global bonds, is down over 12% - a loss of over $6 trillion in value. Certain sectors of the bond market have fared much worse (e.g., the long-term US Treasury bond ETF (“TLT”) is down over 23%).

The chart below comes courtesy of Bianco Research, one of the world’s leading fixed-income experts. The chart shows the year-to-date performance of the Bloomberg Global-Aggregate Total Return Index for every year going back to 1980. Each line represents the price change of the index for a given year. As one can see, the 2022 year-to-date return (in bold) is the worst in the last 40 years.

So, what is causing this drop and what does the future hold for the bond market? To understand why the bond market is falling, one must first understand why it mainly rose for most of the last 40 years. Bond market performance is comprised of two factors (the fixed-income payment that the bonds provide and the price change of the underlying bond itself). If we look at the return attribution of bond market performance over the last 40 years, we learn that a large portion of the market performance came from capital appreciation of the bonds rather than just from the income payments. This occurred because global interest rates were generally falling over this period and bond prices tend to move inversely with prevailing interest rates. For example, look at the chart below which shows the U.S. Federal Funds Rate (i.e., the rate at which banks lend money to each other for overnight reserves). This rate is set by the U.S. Federal Reserve Bank (the “Fed”) and generally drives other interest rates. One can easily see that we’ve been on a 40-year downtrend since peaking in the early 1980s.

So, the lesson here is the Fed (and other central banks) have a massive impact on the bond market through movements in the Federal Funds Rate. So, a falling Federal Funds Rate generally means rising bond prices.

As we look at the recent performance, the market seems to have finally internalized that rates are now heading up after spending much of the last decade at 0%. Inflation has become a very real concern for governments and central banks are aggressively raising rates to combat it. The Fed increased the Federal Funds rate by 50 basis points during its May meeting and the market expects further increases ahead. In fact, based on the pricing of certain futures contracts we can infer that market participants are now expecting the Federal Funds Rate to end the year at over 3% - meaning another 2.25%+ in additional increases are expected.

So, the key question is, “Where does the bond market go from here?” As in the past, we would say the Fed will play a major role. The bond market will be looking to assess any changes from the current expected pace of increases. An acceleration in the raising of the Federal Funds Rate relative to expectations and/or a higher long-term target before it stabilizes will adversely affect bond prices. If the Fed pivots to smaller increases or a lower long-term target, we will likely see a slowing or reversal of the current bond price depreciation. It’s also noteworthy that the Fed has discontinued its bond buying program that was instituted to provide market liquidity. In other words, a very large bond buyer from the last few years (i.e., the Fed) is exiting the bond market which is likely to adversely impact bond prices.

Using history as our guide, the Fed generally increases until something bad happens (i.e., a slowdown in the economy, a spike in unemployment, or deflation) and then they tend to reverse course. So, keeping an eye on these metrics may give you clue to Fed actions. Also, many believe there is now a “Fed Put” on the stock market meaning the Fed would slow down after a certain percentage drop in the overall stock market. Only time will tell on that front.

2022 1st Quarter Update

In our end-of-year update, we warned of a likely pull-back in 2022, and it certainly arrived. US and global equity indices fell considerably with the technology sector faring the worst as expectations for interest-rate increases intensified. Nasdaq indices even reached “bear market” territory (i.e., a decline of 20%+) before surging to close the quarter.

Top Headline for Q1: Nowhere to Hide

In our end-of-year update, we warned of a likely pull-back in 2022, and it certainly arrived. US and global equity indices fell considerably with the technology sector faring the worst as expectations for interest-rate increases intensified. Nasdaq indices even reached “bear market” territory (i.e., a decline of 20%+) before surging to close the quarter. Declines were broad-based with 9 of the 11 S&P 500 Index sectors closing down for the quarter. Despite rallying late in March, Growth (VUG) ended the quarter down 10.3% while Value (SCHV) was down 2.1%. The bond market story was arguably worse; long-dated bond indices fell double-digits, a quarterly slide that the Wall Street Journal reports as the worst in the last forty years. Bond holders seem to have finally capitulated to the fact that rates are headed up and sold off with a fury. To make matters worse, we ended the quarter with an ominous economic sign (i.e.., an “inverted yield-curve”). Inverted yield-curves generally forecast economic recessions which we’ll cover in more detail below in “A Look Ahead.”

General Market Update

US Equities: The expected and perhaps needed pull back in equities finally arrived. The S&P 500 Index fell 4.9% during the quarter, the Nasdaq Composite was down 9.1% and the Russell 2000 Index dropped 7.8%. These pullbacks were expected given the equity market surge heading into the end of 2021 that occurred despite the prospect of rising interest rates, rising wage inflation and continued global supply chain disruptions. Most sectors fell but the Utilities sector (e.g., XLU), which serves as a classic “safe-haven” investment, was up slightly. The outlier was the Energy sector (e.g., XLE was up nearly 40%(!!)), which was buoyed by both an overall shift to value stocks along with massive supply shocks caused by the Russian invasion of Ukraine.

International and Emerging Market Equities: The Schwab International Equity ETF (SCHF), which holds stocks of developed markets excluding the United States, was down 5.5% in Q1, and the Schwab Emerging Markets ETF (SCHE) fell 6.2%. International markets have greatly lagged the US markets in recent history. Given that these equities have a greater tilt toward value and a heavier allocation to sectors that benefit from rising rates/rising inflation, these markets present an interesting potential opportunity ahead.

Fixed Income and Credit: We’ve been beating the drum about bond risk for a long time now. It took longer than we expected to materialize, but the headwinds (i.e., Federal Reserve tapering, planned rate increases and inflation concerns) finally became too overwhelming. The 10-year US Treasury surged from 1.512% at the start of the quarter up to 2.327% by quarter-end. All duration bonds in both corporate and sovereign debt fell hard with long-duration corporates (e.g., VCLT) and sovereigns (e.g., VGLT) dropping over 10%. Fortunately, for Patina Wealth clients, we had an overweight on shorter duration positions (VCSH), which greatly mitigated the impact, as shorter duration bonds have much less overall price volatility.

Commodities, Precious Metals, Inflation: The COVID driven impact on global supply chains continues to be a significant contributor to pockets of inflation. Industrial metals have seen substantial price spikes, and now, with the Russian invasion, energy prices are also spiking. Sadly, we’re also seeing price spikes in food sectors – a problem likely to worsen given the importance of Ukraine to the global food supply chain (e.g., Russia and Ukraine produce over 25% of the world’s wheat). Precious metals may finally be starting to break out to the upside as inflation fears intensity (e.g., Gold, as measured by the ETF GLD, was up 5.7% during the quarter.)

A Look Ahead

In the current market it certainly pays to be nimble. Patina Wealth clients have generally benefited from an overweight to value equity and short-duration bonds heading into 2022. Moreover, our tactical sector overlays, which included exposure to some of the better performing equity sectors in Q1 (e.g., Materials, Energy and Financials), also added value to client portfolios. Moreover, we were more active in shifting exposures during the quarter as rebalancing opportunities emerged.

The inverted yield-curve certainly makes us all nervous as we assess our portfolios. Risk assets generally perform worse during economic cycle downturns as consumer spending drops and the appetite for lending falls (i.e., liquidity tightens for companies of all sizes). It’s important to note that (1) an inverted yield-curve does not portend an immediate recession and (2) market impacts vary wildly from recession to recession. As we look forward, we anticipate continued volatility in 2022 driven mainly from Federal Reserve Bank actions, inactions and verbal commentary. Interest rate changes have massive impacts on bond markets and certain equity segments (e.g., technology). So, in a year where we are predicted to see rates rise by 150-200 basis points, large impacts will unavoidably be felt. Moreover, any material shift by the Federal Reserve Bank (actual or perceived) will likely cause substantial swings in risk assets.

The bond market will be particularly interesting to watch as the over-arching trends in the US are deflationary (e.g., tech-innovation, an aging population, and high levels of indebtedness) suggesting downward pressure on rates and yet rates are spiking. It would not be surprising, in fact, it would be expected based on historical precedent for the market to overestimate rate increases leading to an eventual “oversold” bond market, thus a buying opportunity. On the equity front, we could see some rough earnings reports ahead as inflation (i.e., both higher wages and higher production inputs) do some damage to corporate income statements. However, any sudden reversal from current rate-increase expectations would likely be a tailwind to equities which could override any negative earnings news. As always, we will seek to stay nimble and will actively rebalance portfolios in hopes of capitalizing on any volatility in the markets.

Are We Headed For “Yield Curve Control”?

By now you’re probably thinking what is “yield-curve-control” and why should I care? Yield-curve-control is a term that is widely used among macro-economists and students of interest-rate policy but not among the rest of us. In this article, we’ll discuss what it is, why it may be deployed and how it may impact the investments in your portfolio.

So, first off, what is yield-curve-control? Yield-curve-control refers to a seldom-used strategy by central banks to control interest rates. More specifically, central banks will purchase an unlimited amount of government bonds to support prices. The goal is to create a price “floor” in the government bond market and, consequently, an interest rate “cap.” It is important to differentiate yield-curve-control from quantitative easing. With quantitative easing, the goal of bond purchasing is simply to increase liquidity in the marketplace whereas yield-curve-control has a specific interest-rate target in mind (e.g., a central bank may want to “peg” its 10-year bonds at a rate of 2%).

Now for the key question, why would a central bank want to peg interest rates? If you ask the U.S. Federal Reserve Bank, the answer is that yield-curve-control is simply another tool in the toolbox to achieve its “dual mandate” of (1) price stability and (2) full employment. Obviously, yield-curve-control is not helping price stability so it’s really the economic prosperity/full employment objective that they’re arguably targeting. In this sense, yield-curve-control enhances business activity because it makes capital cheaper than it otherwise wants to be. Corporations become more inclined to borrow, make investments and hire employees while consumers become more capable of making large purchases on credit (e.g., homes). If you artificially lower rates, you’re providing a tailwind to the economy.

For the more skeptical economists, yield-curve-control is deployed primarily as a tactic to control borrowing costs for governments during periods of substantial borrowing by them. In other words, nations can borrow more when interest rates are lower because borrowing costs are not consuming a substantial portion of their annual budgets. So, critics contend that governments are manipulating the bond market simply to keep their costs under control during periods of excessive borrowing. If ever there was a need for the U.S. government to deploy yield-curve-control it is now. The Great Recession and now COVID have resulted in substantial government debt. As shown in the chart below, U.S. debt has climbed to over 100% of U.S. Gross Domestic Product (“GDP”) – a level not seen since World War II.

Source: Federal Reserve Economic Data

So, would central banks really manipulate the bond market in this way? Many would be surprised to learn that several countries, including Australia and Japan, have been actively deploying yield-curve-control in recent years. For example, in 2016 Japan’s central bank made a commitment to target a near-zero interest rate on its 10-year government bonds. Notably, this program has been successful and other central banks are taking notice. For example, data from Japan suggests that the use of capital for yield-curve-control has proven to be more efficient than prior efforts of quantitative easing (i.e., it has a greater effect per dollar deployed).

Perhaps you would be even more surprised to learn that yield-curve-control was actively deployed in the United States from 1942-1951. This is a particularly scary comparison to today because it demonstrates that to reduce its debt a government has an alternative to paying it down – it can use inflation to shrink it. That’s right, from 1942-1951 the United States shrunk its debt as a percentage of GDP not by paying it down but by letting the rate of inflation run well above their interest rate costs. This situation left them with a much more manageable debt load as a percentage of GDP at the end of the period. This realization has led to the expression that “inflation is not a bug but a feature” of federal policy in times of great debt. In other words, governments aren’t necessarily trying to control inflation during times of excessive debt, rather, they’re using it to their advantage. The downside of this tactic is that inflation acts as a tax on consumers as it reduces purchasing power over time – a phenomenon that, unfortunately, is most detrimental to the lowest income earners and retirees living on a fixed income.

Whether it is achieved by yield-curve-control or market forces, our bet is that interest rates will remain relatively low for the foreseeable future. Even though the Federal Reserve Bank has telegraphed rising interest rates in 2022, it seems inconceivable that we’ll return to the rate environment of the early 2000s where a 5% yield on a bank certificate-of-deposit was commonplace. Neither the U.S. government nor U.S. corporations could likely afford to return to that type of rate environment anytime soon.

Given the likelihood of interest rates remaining at relatively low levels, investing becomes more challenging. Both government and corporate bonds may prove less beneficial in the coming years as yields struggle to keep up with inflation – thereby leading to negative “real” yields (i.e., yields net of inflation). Stock market impacts are more difficult to ascertain as artificially low yields are a tailwind to corporations, however, rising inflation generally leads to rising employment costs and shrinking margins. This type of environment tends to be beneficial for “real” assets. Investments such as real-estate, land, precious metals, collectibles and various commodities are often top performers in this environment as investors rush to hedge the effects of inflation and protect purchasing power. Unfortunately, a simple broad-based buy-and-hold stock/bond portfolio may be the worst possible strategy. In our opinion, it may prove most beneficial to deploy a tactical approach to stocks with targeted sector exposures, a dynamic approach to bonds where duration is adjusted throughout the period of rising rates and a healthy allocation to non-traditional pro-inflation assets. We recommend discussing your portfolio’s risk level and diversification with a trusted financial professional.

The Return of Value Investing?

It’s been a long tough road for “value” investors. As we all know by now, the last decade has been very good for risk assets of all stripes. We’ve seen valuations soar in high-risk investment categories like private equity and venture capital. Meanwhile, risk-appetite was equally robust in the public markets as initial public offerings flourished and the technology sector surged. While “growth” was in high demand, “value” investments saw diminished interest. In fact, as shown in the chart below, the recent surge in “growth” has led to one of the largest gaps in outperformance that we’ve ever seen.

Source: Isabet.net

So, where do we go from here? To determine where we may be headed requires us to first understand how we got to this point. We would argue that the dominance of “growth” over the last decade was primarily the result of government intervention. Central banks around the world have been very accommodative to markets after the “Great Recession.” Most notably, we have never seen such an extended period of low interest rates. As the chart below shows, we spent the better part of last decade with the Federal Funds Rate at, or near, zero.

Source: Federal Reserve Economic Data

An interest-rate policy like this has profound impacts on risk assets. For example, large public companies were able to raise money through bond offerings at rock-bottom prices - a situation that greatly benefits firms with good growth prospects. Moreover, low rates mean that future cash flows from “growth” companies are not discounted as much by investors thereby causing them to look more attractive. Of course, interest rates only tell part of the story. It’s clear in hindsight that the injections of liquidity (i.e., the bond buying programs) by central banks and fiscal stimulus by governments encouraged risk taking. It’s also noteworthy that federal bank balance sheet expansion in recent years has been without precedent. For example, as seen in the chart below, the US Federal Reserve Bank increased its balance sheet from around $2 trillion at the start of 2009 to nearly $9 trillion today - a whopping 4.5X increase with half coming in the last 2 years. While it’s clear that “easy money” policies are supportive of all public companies, “growth” categories have more gain under these conditions.

Source: Federal Reserve Economic Data

2022 is shaping up to be an interesting year in the growth/value battle. We ended 2021 with some of the highest inflation prints that we’ve seen in decades. With inflation coming in well above the “target” rate of 2%, federal banks no longer have the luxury of being accommodative. More specifically, there is now immense pressure on them to use their tools to rein in inflation. In theory, this means (1) higher interest rates, (2) the termination of bond buying programs and (3) balance sheet shrinkage. With these potential headwinds for growth, the future is looking brighter for value. Value stocks, which tend to have more stable cash flows, higher dividends and less price sensitivity are primed for a potential comeback.

As we head into 2022 and begin to look at specific sectors, a few categories jump out as being particularly well positioned. For one, the Energy Sector has been out of favor for years following a global “green energy” agenda. However, the transition is predicted to take time, and, following many years of under-investment by the sector, some industry experts expect prolonged high prices and high profits for the sector. Additionally, the Financial Sector may be poised for profit growth. For one, inflation tends to lead to a “steepening” of the yield-curve which improves bank profitability. Moreover, many banks are finding that they over-accrued loan loss reserves in 2020-2021 and are seeing better charge-off results than expected. While it’s impossible to predict exact outcomes, given expected Federal Reserve actions, “value” investors may finally have something to cheer about in 2022.

2021 4th Quarter Update

Top Headline for Q4: The Market Bulls Win!

After a rise in risk sentiment to close the 3rd quarter, one was left to wonder if we had seen the stock market peak for the year; however, the Bulls were not finished. After a strong rally in October, the US equity market had fully recaptured its drawdown and again achieved new all-time highs. In general, equity markets around the globe enjoyed positive returns for the year. The Vanguard Total World Stock ETF (Ticker: VT), which is a blended portfolio of equities spanning domestic and international markets, ended 2021 +18.3%. After some late November and early December volatility, the market saw its biggest 4-day surge of the year before stabilizing to close the year within 1% of another all-time high. In fact, the S&P 500 Index closed at all-time highs on over 25% of all trading days in 2021. This marks the highest total recorded since 1995. Client accounts saw an increased level of rebalancing during the quarter as we rebalance “opportunistically,” instead of specific times during the year (monthly, quarterly, etc.).

What’s quite remarkable about the recent performance is that the macro-level news has not been favorable. For example, in Q4, thanks to the Omicron variant, we endured a resurgence of COVID; the Federal Reserve announced an acceleration of the tapering of their bond buying program; and inflation figures soared, which suggests rates hikes are almost a certainty in 2022. US equity investors shrugged off all of the news and appeared fearless to close the year. And, why not be fearless? The indices spent most of the year hovering at/near all-time highs; the market did not see a drawdown greater than 5% in 2021; and the Federal Reserve, despite the “taper” talk and change of pace, is still “easing” by buying billions in bonds monthly. Yet, as we enter 2022, we’re reminded of Buffett’s famous quote, “Be fearful when others are greedy and be greedy when others are fearful.” As we will later discuss, some caution is warranted as we enter into 2022.

General Market Update

US Equities: The S&P 500 Index surged in the quarter finishing up a whopping 10.6% for Q4 and nearly 27% for the year. The Nasdaq Composite was up 8.3% in the quarter (21.4% for the year), and the Russell 2000 Index climbed 1.9% in the quarter (13.7% for the year). The US equity market performance has been nothing short of stunning. In recent years, the US indices have crushed other major developed market indices. It is noteworthy that some weakness is finally emerging in pockets of the market. Specifically, some of the high-flying performers from recent years (e.g., recent IPOs and “profitless tech”) are down from 2021 peaks and are trending poorly. Moreover, the US market has been led higher by a minority of mega-cap positions. As you may recall in a previous quarterly commentary, we highlighted the fact that about 27% of the S&P 500 Index is comprised of seven mega-cap companies (Apple, Microsoft, Amazon, Tesla, Alphabet, NVIDIA and Meta).

International and Emerging Market Equities: The Schwab International Equity ETF (SCHF), which holds stocks of developed markets excluding the United States, was up 2.8% in Q4. SCHF finished up 11.4% for the year - an obvious divergence from major US indices. This divergence can be traced to the growth/tech bias of the US indices (i.e., the segments that have most benefited from “easy money” federal bank policies). The Schwab Emerging Markets ETF fell 0.7% for both the quarter and year. Emerging market equities continue to be hurt by weakness in China. Looking ahead, we believe this recent underperformance presents an intriguing opportunity.

Fixed Income and Credit: Like Q3, the 4th quarter was a quiet one for the bond market. Both short and long bonds were generally flat for the quarter. With most of the damage being done in the 2nd quarter, 2021 proved to be a rough year for the bond market. It’s hard to see 2022 being much better as the set-up for bonds (i.e., Federal Reserve tapering, planned rate increases and inflation concerns) are big headwinds moving into 2022. We continue to view most segments of the bond market as a buffer for volatility in more conservatively allocated portfolios.

Commodities, Precious Metals, Inflation: Some of the COVID driven inflation is proving transitory, but the general trend in commodity prices in 2021 is up with particular strength in industrial metals related to the “green revolution” (e.g., copper and nickel). Precious metals have been range-bound for much of the year despite favorable conditions (e.g., substantially negative real interest rates). All eyes will be on these sectors in 2022 as price changes will have substantial policy implications.

A Look Ahead

2022 is shaping up to be a very interesting year. The US equity and bond markets are going to be facing headwinds that they haven’t seen in a long time. Specifically, the Federal Reserve’s bond buying program is expected to terminate in Q2. Moreover, interest rate hikes are expected following the tapering of the bond buying program. In general, rising rates are not favorable to the equity market because it raises the cost of capital and causes renewed interest in credit investments. Despite the bond buying taper and expected interest rate increases, both being well telegraphed by the Fed, it would not be surprising to see the market temporarily react unfavorably. An increase in volatility from 2021 is almost a certainty given the unpredictable impacts from what is coming and the above-average current equity market valuation levels. Historically, Value segments of the market tend to outperform during rising interest rate environments. While client portfolios are always well diversified across asset classes, they enter the year with a slight “lean” into Value over Growth. And, as clients know, we like to also express sector market views through our “tactical overlay” to portfolio management. This tactical overlay has a Value overweight through sectors such as Materials, Industrials, Energy and Financials.

To further add to a potentially volatile cocktail, political pressure is intensifying ahead of the 2022 midterm elections. Inflation is soaring and consumers are angry. Anti-corporate sentiment is rising in conjunction with concerns over wealth concentration. Elected officials are pointing fingers and demanding changes which may accelerate any Federal Reserve Bank rate increases. The Fed is supposed to be “independent” of these types of pressures, but it feels less so these days than in the past.

While the year-over-year changes in inflation are certain to fall from current levels, above-average inflation gains continue to feel like a good medium to long-term bet. One of the most unexpected by-products of COVID is that soaring equity markets and bleak working conditions pushed millions of older workers into early retirement. This post-COVID shift left a massive shortfall in the labor force and contributed to the start of wage inflation. Moreover, there are other, more secular, pro-inflation trends including an extremely low level of investment by traditional energy producers and commodity producers in recent years. The government has some control here through the money supply, bank liquidity and interest rates. However, given potential adverse market impacts, will the government use these tools and to what degree? On a more positive note, the widely-covered supply-chain issues that are wreaking havoc on key industries, such as car manufacturing, are likely to see improvement in 2022.

In summary, it’s a very difficult environment for forecasting. We now have conflicting agendas (i.e., what is good for solving issues like inflation and wealth concentration is not generally good for the equity and bond markets). We see volatility in our future as agendas compete for support. It’s been a long time since we’ve seen a substantive drawdown of greater than 10% in the equity markets, but we would not be surprised to see one sometime in the first half of 2022. In any case, volatility brings opportunity to add value through rebalancing portfolios, and we’ll be watching closely. We wish you and yours a very prosperous 2022.

2021 3rd Quarter Update

Top Headline for Q3: Inflation and a Mini-Taper-Tantrum

For the first time in a long time, risk returned to the equity and bond markets. The Federal Reserve began hinting about “tapering” (i.e. slowing its program of monthly bond buying), and at the same time, it’s becoming increasingly clear that inflation is proving more persistent than expected. The combined effect of these factors is starting to cause some strain in the interest rate and bond markets and thus is causing some rumblings in the equity markets.

Below is a YTD chart of the 10-year yield. This chart reflects what we think has been three distinct time periods for the treasury market and equity markets. The first quarter saw a spike in the 10-year yield, peaking on March 31st at 1.75%, as optimism for the economy reopening increased during the vaccine rollout. During this time period Value (LCV) significantly outperformed Growth (LCG). Then, the 10-year yield dropped from 1.75% down to 1.17% in early August. During these four months Growth significantly outperformed Value. One factor driving down yields was the increase in the COVID-19 Delta variant, which raised concerns about the economy slowing down again. As Delta variant numbers began to peak and booster shot information emerged, the 10-year yield started to turn up again. Higher P/E segments of the market (generally, Growth and Technology) tend to perform more favorably in lower interest rate environments, whereas lower P/E segments of the market (Value and Financials, for example) tend to outperform during rising interest rate environments. As such, clients have likely noticed that we have made some adjustments to portfolios during these changes throughout the year.

As an additional illustration, the YTD chart below from DailyShot.com shows the general inverse relationship between the US 10-year and the Nasdaq 100, which has a heavy tilt toward Growth and Technology.

With continued tapering likely in the coming twelve months and inflation proving persistent, one would expect continued volatility in the markets. With volatility comes opportunity for those with good risk-management discipline. We will continue to rebalance portfolios in response to increased volatility in an effort to capitalize on short-term drops and spikes in price.

General Market Update

US Equities: The S&P 500 Index finished the quarter +0.2%; however, this doesn’t tell the full story. The first two months of the quarter were strong with the S&P 500 rising as it had for much of the year before pulling back sharply in September (down almost 5%). September’s pullback was mainly driven by the S&P 500’s heavy technology exposure as the Nasdaq composite was -5.3% for the month. The Nasdaq Composite ended down 0.4% for the quarter while the Russell 2000 Index dropped 4.6%. During the quarter, Large Cap Growth outperformed Value as the Vanguard Large Cap Growth ETF (VUG) was +1.3% while Large Cap Value (Schwab Large Cap Value, SCHV) was -0.8%.

International and Emerging Market Equities: The Schwab International Equity ETF, which holds stocks of developed markets excluding the United States, was down 1.9% in Q3, and the Schwab Emerging Markets ETF fell 7.9%. Emerging market equities were hurt by a dramatic fall in mega-cap technology stocks in China. The Chinese government continues to take action that is unfavorable to its large technology companies. These actions include tightening regulations, forcing break-ups of conglomerates and cracking down on anti-government speech. The Chinese government has injected a lot of uncertainty into its equity markets and investors are clearly concerned.

Fixed Income and Credit: The 3rd quarter was a quiet one for the corporate bond market despite the sharp movement in interest rates. Both short and long bonds were generally flat for the quarter. It’s clear that the government bond buying program continues to have a stabilizing influence.

Commodities and Precious Metals: We continue to see price volatility in commodities as geopolitical tensions remain elevated and supply lines remain strained. However, it appears that the near-term COVID-driven peak in commodity prices is behind us. Much of the “transitory” inflation can be found in this category. In response to rapidly rising interest rates, precious metals and other inflation hedges pulled back slightly during the quarter. However, the global bond market still has over $15 trillion in bonds that are producing “negative yield” when factoring in inflation. Therefore, the short-term sell-off may prove to be a buying opportunity.

A Look Ahead

As we’ve stated for several quarters now, all eyes remain on the Federal Reserve. Given the movement in inflation and rates, one would expect much more price movement in bonds. However, we’re not seeing it. Why? The Federal Reserve continue with “dovish” policies (i.e., low interest rates and bond buying among others). We think this will continue to be favorable for equities. The bond buying has artificially inflated bond prices, especially in the higher-risk (“high-yield”) segment of the market. Without the support, we would likely see lower bond prices, higher yields and, consequently, increased volatility in other risk assets.

So, when do they stop or slow these policies? Among financial experts, the general consensus is that the policies will slow or abate only when the Federal Reserve is forced to alter them. If that is true, then it’s likely that persistent inflation will be the only reason that they may act. We’re starting to see some of that, and Chairman Powell’s recent comments acknowledge that it’s officially “above target.” Our guess, based on Federal Reserve comments, is that we will see the tapering of the bond buying to begin in the coming quarters. However, it is expected that the tapering will be very slow and that raising rates may be quite a ways off. One should pay close attention to inflation, as any major shift on that front could cause the Fed to act more quickly.

We continue to see volatility in the near-term. It’s going to be a messy process to wean off such a high level of government support. Bonds are likely to gyrate as investors try to make sense of any changes. Also, the overall backdrop of low interest rates and light regulation is favorable to stocks, but a changing interest rate environment could outweigh any good news on that front in the short-term. It’s also worth noting that fiscal austerity seems to be the last thing on anyone’s mind right now. As we finish this summary, the US bureaucrats are arguing over a rise in the federal debt limit. They’re spending money at an unprecedented pace and there appears to be no end in sight.

Patina Wealth’s Spookiest Top 10 List

Fall is here, pumpkins and gourds are overflowing your neighbor’s porch and pumpkin-spiced everything is on the menu. This means Halloween is right around the corner! It’s time for Patina Wealth’s Spookiest Top 10 list!

#1 – Being invested in a “load” mutual fund

Did you know that if you are invested in a mutual fund that has a “load” attached to it (its last two ticker symbols are usually AX or BX), the broker who sold that to you most likely received a sales commission? There are several different kinds of “loads”, but, the most common are front-end or back-end loads where the sales commission either happens when the client first invests or when shares are redeemed. Patina Wealth believes this is a clear conflict of interest.

#2 - Not knowing your portfolio allocation details

A diversified portfolio means having exposure to multiple asset classes. A portfolio that is invested in different segments of the market can help buffer volatility during market drawdowns. And, it can help create rebalancing opportunities. We think it helps to have holdings in your portfolio that target specific areas of the market. If your portfolio holds a fund that markets itself as being “balanced”, or, having both stocks and bonds together you likely have found it nearly impossible to know what areas of the market the fund is invested in. Very spooky!

#3 – Not working with a fiduciary

Yikes! Not working with a financial advisor who is obligated to make investment recommendations that are in your best interest can be very scary! Unfortunately, conflicts of interest are far too common in the investment industry. Working with a fiduciary can help make sure you are working with somebody who is putting your interests ahead of their own.

#4 – Investing in an expensive mutual fund

There is a lot of research showing how most actively managed mutual funds fail to beat their benchmark. One of the reasons? High fees. Yikes.

#5 -Taking too much or too little risk

It’s not uncommon for an investor to not know what their appropriate ratio of stocks to bonds should be. A person who is nearing retirement may feel like they should drastically reduce their stock exposure, even though they may need their investments to continue to work for them for another 20-30 years. Or, they may have too much stock exposure, leaving them vulnerable to big portfolio drawdowns. There are a lot of factors that should be taken into account including their own risk appetite, time horizon, or how much they are currently withdrawing to help with living expenses. Working with a fiduciary, actively monitoring your risk exposure throughout the year and having a financial plan in place can help answer these questions.

#6 – Making emotional investment decisions

Seeing your portfolio dip during market pullbacks can be very scary. It is easy to want to sell your holdings out of fear of them dropping more. But, making short-term emotional investment decisions can be even scarier because they can have significant long-term repercussions.

#7 – Not knowing how your financial advisor is paid

A fee-only fiduciary financial advisor should clearly show how he or she is paid. This isn’t always the case when working with advisors or brokers who aren’t fiduciaries. Some are compensated by the funds they invest their clients into, receiving “kickbacks”. This scenario makes it hard to know exactly how much they are getting paid. Very scary!

#8 – Not knowing what you’re invested in

Have you ever invested in something not knowing exactly what you are buying? That can be very spooky. Before investing your hard-earned money, you should know exactly how it fits into your overall portfolio.

#9 – Inadvertently realizing capital gains or incurring withdrawal penalties from retirement accounts

When you sell an investment can make a big difference when tax time comes around. Paying short-term capital gains versus long-term capital gains can be frightening. And, mistakenly withdrawing from your 401(k) or IRA before you are allowed to can bring an unwelcome tax bill and early withdrawal penalty.

#10 – Not saving in the most appropriate investment vehicle

ROTH IRAs, Traditional IRAs, Traditional 401(k)s, ROTH 401(k)s, 529 savings accounts, taxable brokerage accounts, the list of different investment accounts goes on. They all provide different advantages and some are more appropriate for each person than others. For example, will your income be higher in retirement than it is now? Are you taking advantage of tax breaks in certain investment vehicles? Properly planning right now can make a big difference in the future. Working with a fiduciary can take the fear out of retirement planning!

If any of these sound familiar to you, we can help!

The Inflation Tug-of-War

There is a lot of “inflation” talk in the press today. Prices of houses, used cars and certain grocery items appear to be soaring while the Federal Reserve Bank assures us that any inflation is “transitory” (i.e., temporary). But, are they right? Make no mistake, we’re at an interesting inflection point regarding inflation that could have a tremendous impact on our lives. So, let’s take a deeper look at where things may be headed.

So, first off, let’s answer the question – “What causes inflation?” Economists have differing opinions on this one but they tend to agree that inflation can be “demand-driven” or “supply-driven.” Demand-driven inflation results from too many people demanding the same goods and services while production can’t keep up. This situation may arise in economies that are doing really well to the point of “overheating” (i.e., extremely low unemployment, high wages, etc.) and is especially common when a country’s population skews toward the consumption-heavy age cohort (i.e., 30-50). Supply-driven inflation tends to refer to inflation caused by “supply shocks” which are generally short-term disruptions in production and supply-chains caused by things like geo-political tensions, natural disasters and pandemics.

People who believe that our current inflation is transitory tend to argue that the cause is, in fact, the COVID-19 Pandemic which has wreaked havoc on global supply chains and the labor supply. Moreover, they point to an aging population, rapid technological advancements and high levels of debt as significant deflationary headwinds in the developed world. They are correct on these points and, under normal circumstances, the transitory argument would seem to be the winner. However, another key factor in the ongoing inflation debate revolves around the money supply which has grown at truly remarkable levels. The chart below shows how significant this growth is.

Credit: FRED Economic Data

Governments have been aggressively borrowing with most of the debt being purchased by central banks leading to a “monetization of the debt” and growing money supplies. Many argue that, while devaluing a currency in this way may create tailwinds for inflation, it doesn’t necessarily cause inflation (i.e., it doesn’t create demand). But, we’ve never seen anything like this before so history offers no lesson for what we are now experiencing.

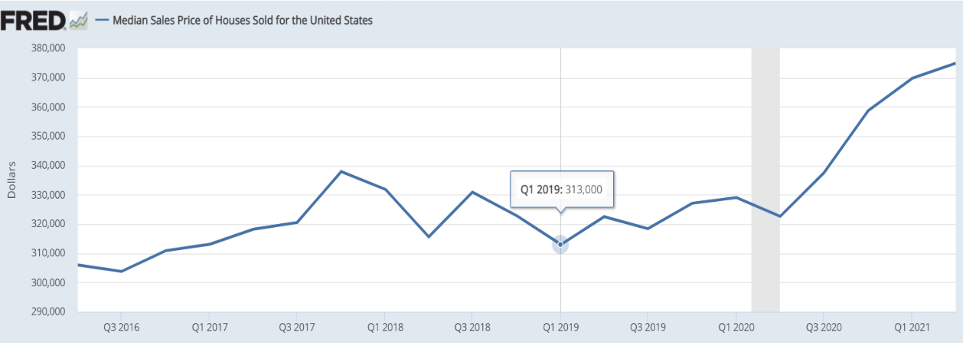

Given that we are in the midst of a grand experiment by governments and central banks, it’s important to monitor the impacts closely. One impact that now appears obvious is that, without government intervention, the stock market would be much lower than it is today. The same can be said for the bond market and commercial real estate. In general, it is common consensus that we are experiencing inflation in risk assets of all stripes. The “wealth effect” caused by rising portfolio valuations, may be carrying over to other areas such as housing. As the chart below shows, we’ve seen a rapid recent spike in the median home value in the United States. It’s likely that we will see “wealth effect” inflation crop up in other areas, especially among goods demanded by the world’s wealthiest who have been the primary beneficiaries of this surge in values.

Credit: FRED Economic Data

So, where does inflation go from here? The core environmental factors (aging population, technologic advancement, etc.) are deflationary while short-term disruptions (e.g., COVID-19) are inflationary. Meanwhile, government intervention in the form of the rapidly-growing money supply and perpetually low interest rates certainly raises the risk of inflation. In short, it appears that the federal governments hold a lot of control. While it’s impossible to predict future government actions, given the rising risk of inflation, investment portfolios may benefit from some adjustments. Inflation can appear quickly and can be very detrimental to many asset classes.

Projecting the equity market is perhaps the trickiest endeavor of all. The increase in money supply, in combination with historically low interest rates, has clearly positively impacted the equity market. It would likely continue to do so if these conditions persist. But, when does it end? The federal governments have created a risky set-up for equity markets in that any reduction in money supply or increase in rates could create a stampede for the door. As such, it’s important to hold quality assets through a diversified portfolio that you’re comfortable holding through any market conditions.

2021 2nd Quarter Update

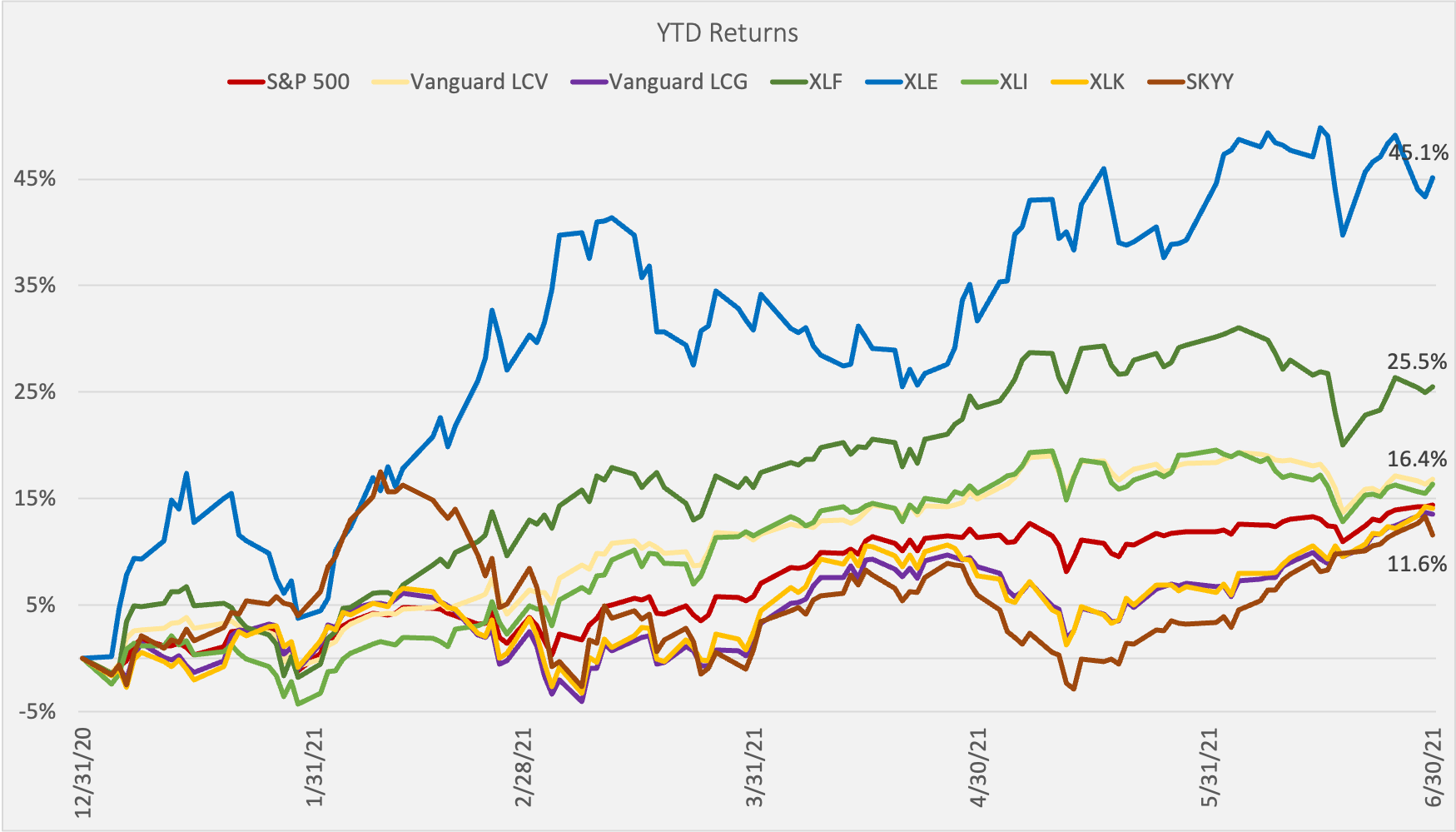

Top Headline for Q2: Continued Rotation with Rising Fed Dependency

In some ways the second quarter was a continuation of the first. Value trades continued to perform well with more economically sensitive sectors like energy, financials, and industrials pushing higher. Energy proved to be the top performer year-to-date with XLE up 45.1% through June 30th. However, it’s also noteworthy that all equity sectors performed well. The overall stock market has now been up for 6 months in a row, 5 quarters in a row and it seems to be making new all-time highs on a weekly basis. It’s becoming more and more clear that Federal Reserve Bank actions are having a massive impact on markets. The increased liquidity and interest rate impact from the continued $120 billion in monthly bond buying, along with guidance surrounding interest rates, is proving to be a massive tailwind for risk assets.

General Market Update

US Equities: The S&P 500 Index finished up 8.2% for the quarter and the Nasdaq Composite was up 9.5%. The Russell 2000 small cap index lagged a bit – rising “only” 4.1%. Growth made a late 2nd quarter comeback, benefiting from a drop in yields during the quarter. The Vanguard Large Cap Growth ETF (VUG) ended the quarter up 11.7% while its Value counterpart, Vanguard Large Cap Value (VTV) was up 5.1%. Two other notable 2nd quarter “comebacks” were the Technology (XLK) sector, which was up 11.4% in 2Q after only being up 2.4% in 1Q, and Cloud Computing (SKYY), which was up 10.7% in 2Q after being up 0.8% in 1Q. Despite this Growth comeback, several Value subsectors, which Patina Wealth portfolios have exposure to, performed well during Q2. Energy (XLE) ended Q2 up 10.9%, putting it up 45.1% YTD and Financials (XLF) ended Q2 up 8.2%, putting it up 25.5% YTD. The stock market is clicking on all cylinders at this point benefitting from a number of tailwinds including fiscal and monetary support from the federal government and continued good news related to the COVID-19 virus in the United States.

Data Source: Yahoo Finance

International and Emerging Market Equities: The Schwab International Equity ETF, which holds stocks of developed markets excluding the United States, was up 4.9% in Q2 and the Schwab Emerging Markets ETF was up 3.5%. The international market has lagged US indices in recent quarters likely due to better news on the US COVID front, including increased vaccine penetration and general reopening optimism. Emerging markets continue to have attractive relative valuations but the emergence of COVID variants is a greater threat in the sector and will likely limit growth for a bit longer. For example, the daily COVID numbers in India has subsided but saw a substantial spike during Q2.

Fixed Income and Credit: The 2nd quarter was an interesting one for the bond market. After a very rough first quarter where bond prices tanked on “re-opening” optimism, rates tended to trend downward in Q2 as bond prices generally rose. After seeing the 10-year treasury bond yield rise from 0.92% to 1.75% during the 1st quarter, it fell back down to 1.44% by the end of Q2. This was a bit of an unusual move as the equity market optimism and inflation talk would normally lead to falling bond prices and rising yields. It’s possible that Q1 may have been an overshoot of inflation expectations leading to a short-term decline in Q2.

Data Source: Yahoo Finance

Commodities and Precious Metals: Many commodities continued to rise during the quarter as supply chain issues resolve slowly. It remains unclear whether some of these price movements will prove “transitory” as indicated by the Federal Reserve Bank. Precious metals continue to trend sideways as uncertainty persists on the inflation front and risk assets continue to perform well, offering an attractive alternative. Real yields continue to be negative which would normally be a bullish environment for precious metals but the relentless rise in risk assets is limiting investment flows into the category.

A Look Ahead

It feels like we’re getting near the end of the easy money policies from the Federal Reserve Bank. They’ve indicated that they are not likely to raise rates for quite some time but they also indicated that a tapering of their bond buying may be in the cards for the 2nd half of 2021. It’s tough to tell (1) if they’re going to follow through on this action and (2) if so, what impact it will have on markets. Using the last 10 years as a guide, the stock market will not react favorably to any tapering or talk of raising interest rates so it’s important to watch Fed actions closely.

It’s also noteworthy that political pressures are building that could adversely impact equity markets in the long-term. For example, there is further discussion around increased corporate taxation, increased minimum wage, and a general disdain for a rising “wealth gap” that could lead to policies disadvantageous to large businesses. There is also a renewed call for updating of the anti-monopoly policies which could threaten the FAANG complex and other large cap companies.

It would not be surprising to see some increased volatility in the coming quarter. It’s not normal for equity markets to go up in a straight line and we’re long overdue for a pull back. However, the overall landscape is still very favorable to stocks and we’d view any pull back as an opportunity. Rock bottom interest rates, continued Federal Reserve Bank bond buying, aggressive federal government spending packages and a slow-moving congressional process suggests a bright near-term future for equities. Plus, COVID news continues to be positive and consumer enthusiasm is strong, leading to what will likely be historic GDP growth.

So, where does the rubber hit the road? You can’t get something for nothing and it’s clear that as a nation we’re spending money we don’t have. That is, we’re running massive deficits leading to record federal debt levels and increasing the money supply/devaluing the currency to deal with it. One would expect this environment to be inflationary. Clearly, we’re seeing inflation in some areas (e.g., risk assets, home prices, car prices, etc.). Our bet is that, in the long term, asset inflation is the path out of the current debt dilemma for Federal Banks. That is, there is no obvious path to paying down the debt through austerity so it’s likely that federal policy will allow inflation to rise well above prevailing interest rates in an effort to deflate the relative size of the debt. This tactic may also involve continued bond buying as a form of “yield curve control” to ensure that interest rates (aka debt costs) do not grow to an unsustainable level. Given this backdrop, real assets and precious metals will likely see renewed interest as an investment when/if equity markets cool down a bit.

Value Investing - Rising From the Dead

Buying “Value stocks” (i.e., public companies at reasonable prices relative to fundamentals) has been a hallmark of investing for over 100 years. Legendary investors like Warren Buffet parlayed the concept into billions of investment profits and many academics, like the famous Eugene Fama and Kenneth French, find it to be one of the primary factors explaining future stock outperformance. So, what has been happening to Value since the “Great Recession” – a period marked by the greatest underperformance of Value stocks versus Growth stocks in history? And, where do we go from here?

That last 10+ years have not been kind to Value. Over the last decade, the Russell 1000 Growth Index gained about 17% per year while the Russell 1000 Value Index gained about 10% per year. The outperformance has been so consistent and dramatic that some have claimed that “Value is dead.” It’s hard to argue with the results, especially when recent performance has been so lopsided. In 2020, The Vanguard Russell 1000 Growth ETF, VONG, was +38.3% while its Value counterpart, the Vanguard Russell 1000 Value ETF, VONV, was only +2.6%.

To understand this relative outperformance, let’s first look at some of the causes. We would argue that the primary driver of the general outperformance of Growth over Value has been government stimulus. Growth stocks are heavily impacted first and foremost by interest rates. Growth stocks expect cash flows to materialize further into the future than Value stocks so, when rates are low, there is less of a negative impact from discounting those cash flows to the present. As you may recall, the Federal Reserve Bank lowered the benchmark interest rate to near 0 coming out of the Great Recession and generally left it there for the better part of the last 13 years. They lifted rates a bit from 2015 to 2019 but the move was gradual and the benchmark rate barely rose during the period – peaking at just under 2.5%.

In addition to lowering rates, the Federal Reserve bank created the additional tailwind of increasing the money supply by buying bonds in the open market. These moves created an “easy money” policy where capital was generally free-flowing to large companies. Finally, in response to the COVID crisis, the Federal Reserve Bank began buying bonds of individual companies including behemoths like Apple. The net effect of this activity was to drop borrowing costs for large Growth companies to barely above US Treasury rates. In summary, cash has been easy and cheap for large public companies – a situation that helps all companies but is especially bullish for Growth stocks.

While rates remain low, it seems the market may now be predicting a possible regime change. So far in 2021, we’ve seen a noticeable rebound of Value stocks over Growth. For example, the deep Value energy sector ETF (XLE) is up 31.7% year-to-date through the end of April versus 7.7% for the high Growth tech sector ETF (XLK). A similar story is seen in Financials (XLF) which is up 23.5% and Industrials (XLI) which is up 15.5%. So, are we seeing a short-term blip in performance or a new secular trend?

Part of the recent outperformance of Value is simply optimism coming out of 2020. The same sectors that were beaten up in 2020 (e.g., Financials, Energy, etc.) are now some of the top performers. As the world continues to gain control of the COVID virus and economies re-open it stands to reason that the beaten-down sectors would see some immediate recovery. Financials are also benefiting from a steepening yield curve while the energy sector is seeing rapidly rising demand from renewed interest in business and leisure travel.

As we look forward, much of the market performance will depend on the actions of the Federal Reserve Bank. If rates stay low, Growth is likely to continue to be a top relative performer but, if not, one would expect earnings multiples to compress which would be a huge headwind for the sector. Overall, our bet is that we’re long overdue for some sustained Value outperformance. We see a number of tailwinds for Value relative to Growth including (1) the price to earnings spread between Value and Growth is extended relative to historical norms and (2) we’re seeing strong economic and employment Growth – meaning the risk of inflation has increased along with the prospect of future interest rate increases.

2021 1st Quarter Update

Top Headline for Q1: Investors Predict a Recovery

The most noteworthy price action of the first quarter occurred in long-duration bonds where a sharp decline suggests continued optimism among investors. With COVID vaccine rollouts accelerating and more “easy money” policies from federal banks throughout the world, investors have hopped on the reopening bandwagon. As investors anticipated a potential pick-up in business activity and possible inflation, long duration bonds saw significant declines. The 30-year US treasury bond plummeted about 15% - an abrupt and massive move for a market that had been relatively quiet.

The bond market action and investor enthusiasm carried over to the equity market. 2020 “winners” (i.e., high growth companies that saw massive price/earnings multiple expansion) began to move sideways or down. Growth companies did not react well to increasing interest rates as their future value is more sensitive to higher rates. The 10-year treasury started 2021 at 0.92% and ended the quarter at 1.75%. Investors shifted to previously beaten-up sectors such as financials, industrials and energy. Patina Wealth investors benefited from this shift as we began shifting some portfolio allocation from Growth and Technology into Financials and Industrials beginning in 4Q 2020.

General Market Update

US Equities: The S&P 500 Index finished up 5.8% for the quarter, while the more growth-oriented Nasdaq Composite was up only 2.8%. After Growth significantly outperformed Value last year, the opposite happened in Q1. Schwab’s Large Cap Value ETF was +9.7% while Schwab Large Cap Growth was only +1.1%. The big winner for the quarter was small capitalization stocks which were up 12.4%. The small-cap segment benefitted from a number of tailwinds including, (1) a heavy value orientation given its exposure to financial service companies and (2) a massive run up in heavily shorted growth-oriented stocks stemming from the Gamestop retail investor frenzy. Small-cap performance, especially small-cap growth, is likely to be a bit choppier going forward as many of these heavily-shorted names are likely to return to appropriate prices. US equity market valuations generally remain elevated relative to historical norms driven mostly by the growth sector whereas many value-oriented sectors are trading at more reasonable valuations.

International and Emerging Market Equities: The Schwab International Equity ETF, which holds stocks of developed markets excluding the United States, was up 4.5% in Q1 and the Schwab Emerging Markets ETF was up 3.7%. The developed international market has struggled in recent years relative to tech-heavy US large-cap indices which generally prove more attractive in a low interest rate environment. If bond markets continue to trend down thereby lifting prevailing interest rates, we may see some renewed investor enthusiasm for the developed foreign equity markets. Emerging markets appear to be a bright spot for investors on a forward-looking basis where below average stock valuations, favorable demographics and positive GDP forecasts offer enticing tailwinds.

Fixed Income and Credit: As mentioned above, Q1 2021 was a rough quarter for the bond market. Mid to long-term bonds saw substantial price declines. Corporate bonds faired a bit better than treasuries given (1) the re-opening enthusiasm and corresponding risk-taking that led to an exodus from the “safe haven” of US Treasuries and (2) the higher-yielding corporates are slightly less impacted from a rise in inflation expectations.