The Inflation Tug-of-War

There is a lot of “inflation” talk in the press today. Prices of houses, used cars and certain grocery items appear to be soaring while the Federal Reserve Bank assures us that any inflation is “transitory” (i.e., temporary). But, are they right? Make no mistake, we’re at an interesting inflection point regarding inflation that could have a tremendous impact on our lives. So, let’s take a deeper look at where things may be headed.

So, first off, let’s answer the question – “What causes inflation?” Economists have differing opinions on this one but they tend to agree that inflation can be “demand-driven” or “supply-driven.” Demand-driven inflation results from too many people demanding the same goods and services while production can’t keep up. This situation may arise in economies that are doing really well to the point of “overheating” (i.e., extremely low unemployment, high wages, etc.) and is especially common when a country’s population skews toward the consumption-heavy age cohort (i.e., 30-50). Supply-driven inflation tends to refer to inflation caused by “supply shocks” which are generally short-term disruptions in production and supply-chains caused by things like geo-political tensions, natural disasters and pandemics.

People who believe that our current inflation is transitory tend to argue that the cause is, in fact, the COVID-19 Pandemic which has wreaked havoc on global supply chains and the labor supply. Moreover, they point to an aging population, rapid technological advancements and high levels of debt as significant deflationary headwinds in the developed world. They are correct on these points and, under normal circumstances, the transitory argument would seem to be the winner. However, another key factor in the ongoing inflation debate revolves around the money supply which has grown at truly remarkable levels. The chart below shows how significant this growth is.

Credit: FRED Economic Data

Governments have been aggressively borrowing with most of the debt being purchased by central banks leading to a “monetization of the debt” and growing money supplies. Many argue that, while devaluing a currency in this way may create tailwinds for inflation, it doesn’t necessarily cause inflation (i.e., it doesn’t create demand). But, we’ve never seen anything like this before so history offers no lesson for what we are now experiencing.

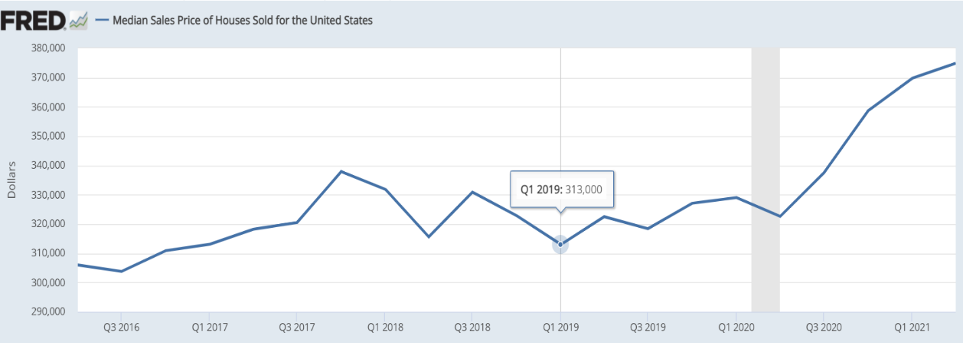

Given that we are in the midst of a grand experiment by governments and central banks, it’s important to monitor the impacts closely. One impact that now appears obvious is that, without government intervention, the stock market would be much lower than it is today. The same can be said for the bond market and commercial real estate. In general, it is common consensus that we are experiencing inflation in risk assets of all stripes. The “wealth effect” caused by rising portfolio valuations, may be carrying over to other areas such as housing. As the chart below shows, we’ve seen a rapid recent spike in the median home value in the United States. It’s likely that we will see “wealth effect” inflation crop up in other areas, especially among goods demanded by the world’s wealthiest who have been the primary beneficiaries of this surge in values.

Credit: FRED Economic Data

So, where does inflation go from here? The core environmental factors (aging population, technologic advancement, etc.) are deflationary while short-term disruptions (e.g., COVID-19) are inflationary. Meanwhile, government intervention in the form of the rapidly-growing money supply and perpetually low interest rates certainly raises the risk of inflation. In short, it appears that the federal governments hold a lot of control. While it’s impossible to predict future government actions, given the rising risk of inflation, investment portfolios may benefit from some adjustments. Inflation can appear quickly and can be very detrimental to many asset classes.

Projecting the equity market is perhaps the trickiest endeavor of all. The increase in money supply, in combination with historically low interest rates, has clearly positively impacted the equity market. It would likely continue to do so if these conditions persist. But, when does it end? The federal governments have created a risky set-up for equity markets in that any reduction in money supply or increase in rates could create a stampede for the door. As such, it’s important to hold quality assets through a diversified portfolio that you’re comfortable holding through any market conditions.