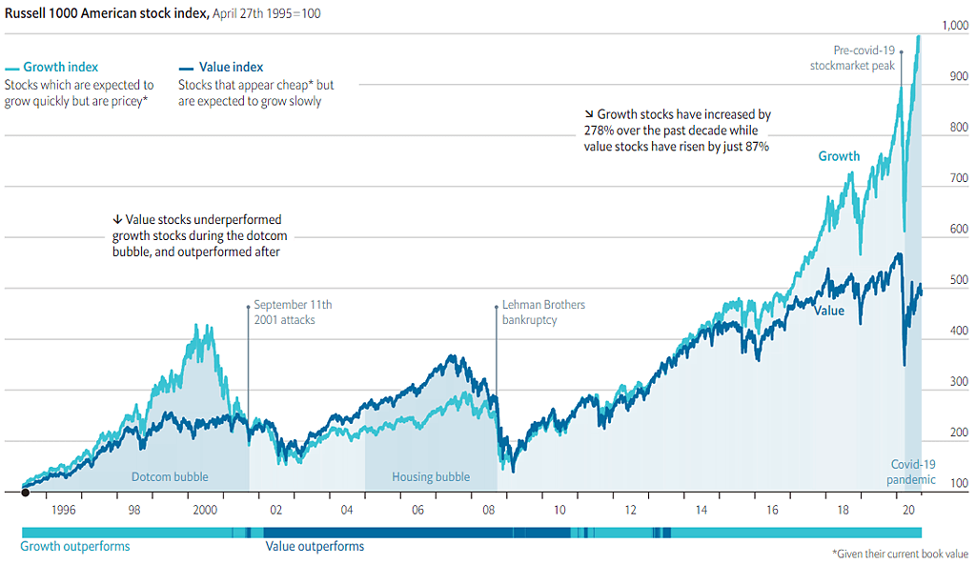

The Return of Value Investing?

It’s been a long tough road for “value” investors. As we all know by now, the last decade has been very good for risk assets of all stripes. We’ve seen valuations soar in high-risk investment categories like private equity and venture capital. Meanwhile, risk-appetite was equally robust in the public markets as initial public offerings flourished and the technology sector surged. While “growth” was in high demand, “value” investments saw diminished interest. In fact, as shown in the chart below, the recent surge in “growth” has led to one of the largest gaps in outperformance that we’ve ever seen.

Source: Isabet.net

So, where do we go from here? To determine where we may be headed requires us to first understand how we got to this point. We would argue that the dominance of “growth” over the last decade was primarily the result of government intervention. Central banks around the world have been very accommodative to markets after the “Great Recession.” Most notably, we have never seen such an extended period of low interest rates. As the chart below shows, we spent the better part of last decade with the Federal Funds Rate at, or near, zero.

Source: Federal Reserve Economic Data

An interest-rate policy like this has profound impacts on risk assets. For example, large public companies were able to raise money through bond offerings at rock-bottom prices - a situation that greatly benefits firms with good growth prospects. Moreover, low rates mean that future cash flows from “growth” companies are not discounted as much by investors thereby causing them to look more attractive. Of course, interest rates only tell part of the story. It’s clear in hindsight that the injections of liquidity (i.e., the bond buying programs) by central banks and fiscal stimulus by governments encouraged risk taking. It’s also noteworthy that federal bank balance sheet expansion in recent years has been without precedent. For example, as seen in the chart below, the US Federal Reserve Bank increased its balance sheet from around $2 trillion at the start of 2009 to nearly $9 trillion today - a whopping 4.5X increase with half coming in the last 2 years. While it’s clear that “easy money” policies are supportive of all public companies, “growth” categories have more gain under these conditions.

Source: Federal Reserve Economic Data

2022 is shaping up to be an interesting year in the growth/value battle. We ended 2021 with some of the highest inflation prints that we’ve seen in decades. With inflation coming in well above the “target” rate of 2%, federal banks no longer have the luxury of being accommodative. More specifically, there is now immense pressure on them to use their tools to rein in inflation. In theory, this means (1) higher interest rates, (2) the termination of bond buying programs and (3) balance sheet shrinkage. With these potential headwinds for growth, the future is looking brighter for value. Value stocks, which tend to have more stable cash flows, higher dividends and less price sensitivity are primed for a potential comeback.

As we head into 2022 and begin to look at specific sectors, a few categories jump out as being particularly well positioned. For one, the Energy Sector has been out of favor for years following a global “green energy” agenda. However, the transition is predicted to take time, and, following many years of under-investment by the sector, some industry experts expect prolonged high prices and high profits for the sector. Additionally, the Financial Sector may be poised for profit growth. For one, inflation tends to lead to a “steepening” of the yield-curve which improves bank profitability. Moreover, many banks are finding that they over-accrued loan loss reserves in 2020-2021 and are seeing better charge-off results than expected. While it’s impossible to predict exact outcomes, given expected Federal Reserve actions, “value” investors may finally have something to cheer about in 2022.